Decoding Crypto Climates: A Sentimental Journey Through Volatility

The crypto market, a realm of digital innovation and financial frontier, is notorious for its dramatic swings. While technical analysis and fundamental research are vital tools for navigating this space, they often fall short in capturing the underlying force that truly propels prices: *sentiment*. Enter the Crypto Fear & Greed Index, a compass designed to chart the emotional currents that drive the market. This report delves into the principles, mechanics, and practical implications of this index, offering a comprehensive understanding of its role in the crypto ecosystem.

Unveiling Market Psychology: The Fear & Greed Spectrum

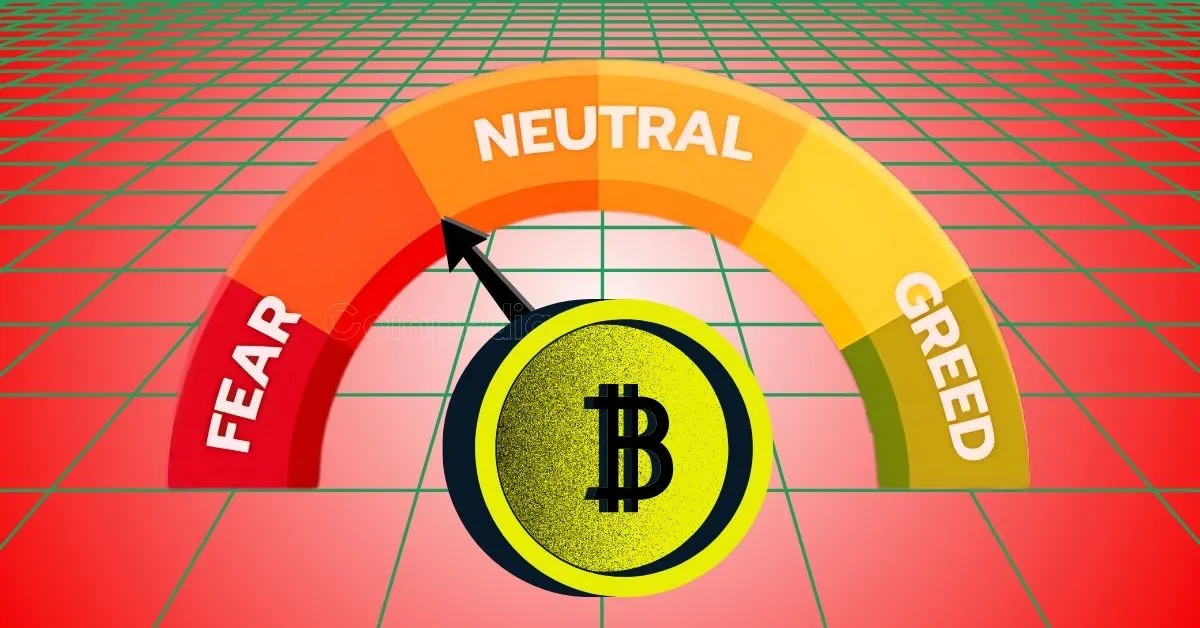

Imagine a gauge that reflects the collective mood of crypto investors, ranging from paralyzing fear to unbridled greed. That, in essence, is the Crypto Fear & Greed Index. Its basic concept rests on the observation that extreme fear can lead to panic selling and undervaluation, while excessive greed can inflate prices and foreshadow corrections. The index quantifies this emotional spectrum on a scale of 0 to 100. A score of 0 signifies “Extreme Fear,” indicating widespread pessimism, potential bargain buys, and possible market bottoms. A score of 100 represents “Extreme Greed,” signaling overzealous optimism, market tops, and increased risk of a downturn.

The idea of gauging market sentiment isn’t unique to crypto. Traditional finance has long recognized the power of investor psychology. The Crypto Fear & Greed Index adapts this time-tested principle to the unique volatility and dynamics of the digital asset space, where social media buzz, breaking news, and regulatory pronouncements can ignite rapid shifts in market sentiment.

Deconstructing the Index: A Symphony of Data Points

The Crypto Fear & Greed Index isn’t a magic number pulled from thin air; it’s a carefully constructed composite indicator that synthesizes data from various market sources. While specific weighting might vary across different platforms that track the index – including prominent names like Alternative.me, Binance, and CoinMarketCap, the core components generally include:

- Volatile Swings: High market volatility in either direction can indicate increasing fear and greed within investors. The greater the volatility, the more extreme the reading typically becomes.

- Momentum & Volume: When the market experiences high trading volumes and strong buying pressure, it may reflect increasing greed. When markets decline, coupled with lower volumes, fear can be detected.

- Social Media’s Echo Chamber: By analyzing the tone and frequency of crypto-related conversations on social media platforms, the index gauges collective sentiment. Positive buzz contributes to greed, while negative discussions fuel fear.

- Surveying the Masses: Some iterations of the index incorporate surveys or polls to directly measure investor sentiment, providing a real-time snapshot of their market outlook.

- Bitcoin’s Reign: Bitcoin’s dominance within the crypto market plays a role, with an increase in dominance, indicating a flight to safety during times of fear.

- Hyper Attention: The level of hype and media attention surrounding cryptocurrencies contributes to overall greed levels and can be assessed through search trends.

Some providers, like Binance Square, emphasize incorporating “trading data and unique user behavior insights” for a more precise analysis. Other providers, like CoinGlass, focus on analyzing factors across “multiple markets.” The aggregation of these inputs helps paint a well-rounded picture of the market’s emotional temperature.

Leveraging Fear & Greed: A Guide for Crypto Navigators

The Crypto Fear & Greed Index isn’t capable of predicting the future, but it provides valuable context for informed decision-making. Here’s how both seasoned traders and casual investors can integrate it into their crypto strategy:

- The Contrarian’s Edge: The index is best used as a contrarian indicator. When extreme fear grips the market, creating a low score, savvy investors might see a buying opportunity in undervalued assets. When extreme greed pervades, resulting in a high score, it can signal the need for profit-taking or caution.

- Confirming the Course: The index can confirm signals generated by technical analysis. A technical indicator suggesting a price reversal, for example, is enhanced by a corresponding low Fear & Greed Index score, strengthening the bullish case.

- Taming the Risk Beast: Understanding the broader sentiment can help you adapt your risk exposure. Reducing portfolio risk during extreme greed and embracing aggressive strategies during extreme fear can prove effective.

- Detecting Cycle Shifts: Recognizing market cycle inflection points is paramount for any crypto investor. Extreme fear can pinpoint the bottom of a bear market, and extreme greed, the top of a bull market.

- Timing the Tide: Short-term traders can use the index to identify potential opportunities, gauging momentary peaks and valleys.

Mudrex, in particular, highlights the index’s ability to assist in “timely decision-making for buying and selling opportunities,” and CoinMarketCap emphasizes its ability to help investors “stay ahead of market trends.”

Real-Time Access: Tracking the Pulse of the Market

The Crypto Fear & Greed Index is highly accessible and updated in real-time. Multiple platforms, including CoinStats and Cointree, provide live data feeds, often refreshed every few minutes. Historical data is also widely available, enabling savvy analysts to identify patterns and recurring trends from previous market cycles.

The active presence of a dedicated X account (@BitcoinFear) reinforces the index’s commitment to real-time information sharing. As of June 17, 2025, for example, the index registered a value of 68, indicating a state of “Greed” permeating the market.

Caveats and Considerations: Navigating with Nuance

While a useful barometer, the Crypto Fear & Greed Index isn’t perfect. Be wary of the following limitations.

- Interpreting Sentiment (Subjectively): The index relies on data, but the interpretation of sentiment remains inherently subjective.

- The Art of Manipulation: Social media sentiment can be artificially manipulated, potentially skewing the index.

- Looking in the Rearview Mirror: As a lagging indicator, the index often reflects past sentiment rather than predicting future events.

- One Piece of the Puzzle: The index shouldn’t be used in isolation. It’s most powerful when integrated with technical analysis and fundamental research.

Charting a Course Through Crypto’s Emotional Seas

The Crypto Fear & Greed Index provides a crucial perspective on the volatile cryptocurrency market. By quantifying the emotional landscape, it highlights opportunities and potential risks. While not a crystal ball, it is a vital component of a balanced investment strategy, empowering those who trade and invest to navigate complexities with clarity. Its accessible, real-time, multifactorial methodology solidifies its status as a key tool for understanding the motivations behind price movement in crypto.