Nvidia, a pioneer in GPU technology and a cornerstone of the AI revolution, has recently drawn significant attention due to insider stock sales exceeding $1 billion over the past year. This substantial divestiture coincides with Nvidia’s shares reaching record highs, fueled by surging investor enthusiasm for artificial intelligence. Understanding the context, motivations, and market implications behind such significant insider selling offers valuable insights into Nvidia’s current position and future prospects.

The Scale and Timing of Insider Sales

Over the last 12 months, Nvidia insiders—including executives and board members—have sold more than $1 billion worth of company stock, with about half of this volume occurring in just the past month. This recent spike in sales took place as Nvidia’s share price reached unprecedented levels, driven largely by global excitement over artificial intelligence technologies and the crucial role Nvidia chips play in AI systems.

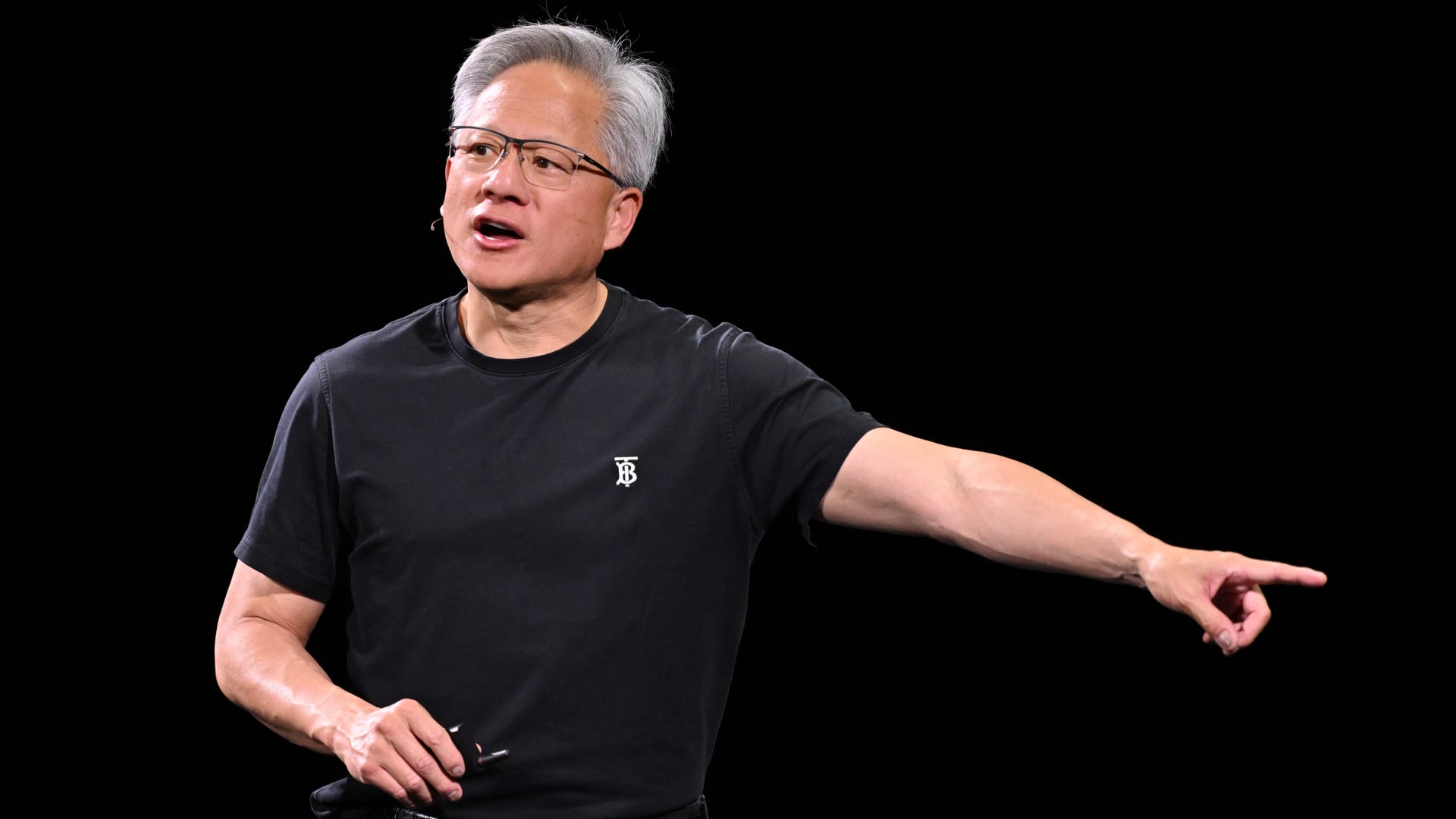

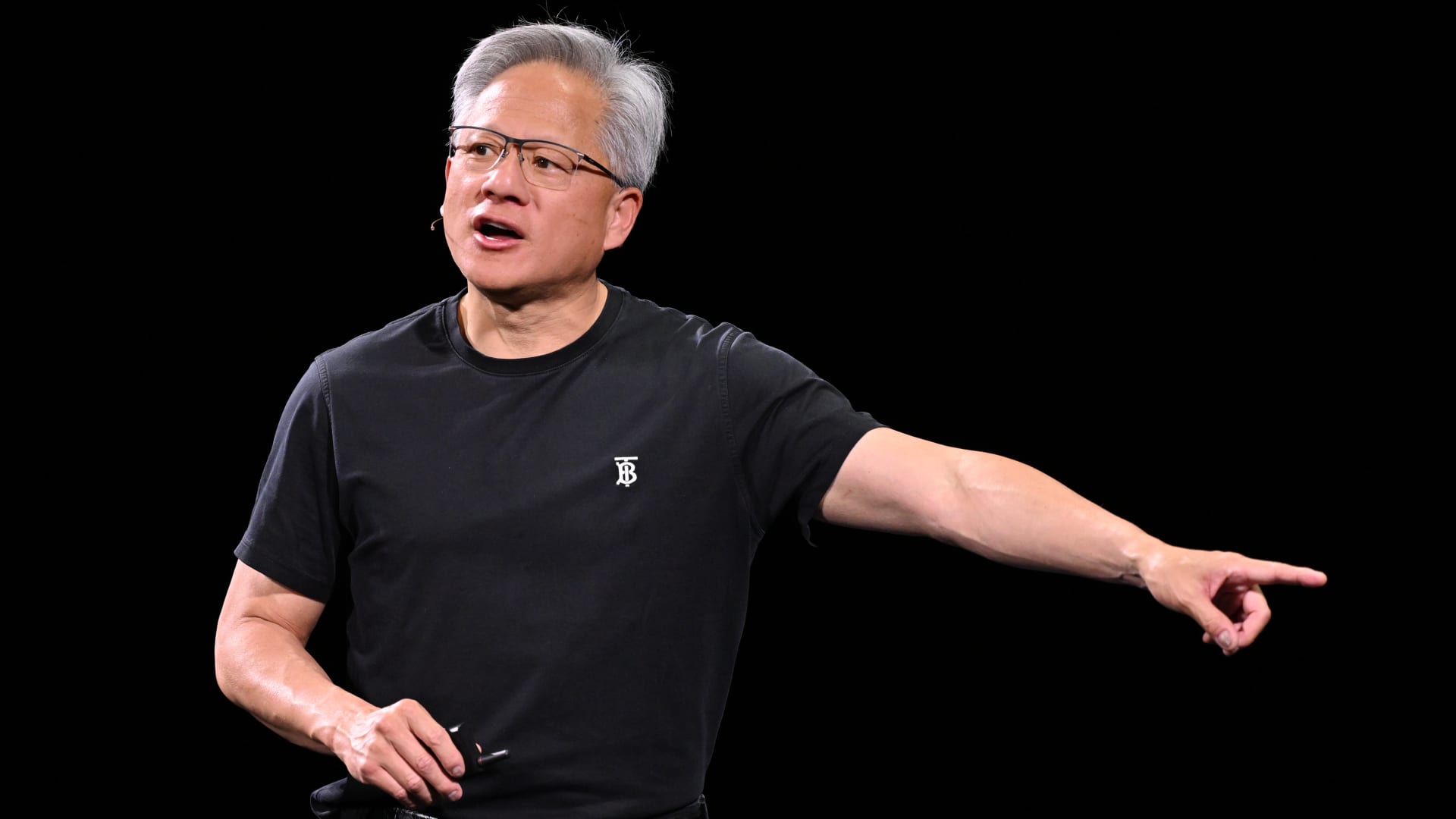

Notably, CEO Jensen Huang began selling shares recently after a hiatus since the previous September. His stock sales mirror the broader trend among Nvidia leadership and reflect strategic market timing rather than panic or a lack of confidence. Additionally, the company’s board has approved a massive $50 billion stock buyback program, signaling confidence in the company’s long-term value and potentially offsetting the share dilution effect of insider selling.

Why Are Nvidia Insiders Selling So Much Stock?

Capitalizing on Peak Valuations

Insider sales often coincide with peak valuations as executives take the opportunity to monetize substantial paper gains accrued during impressive stock run-ups. Nvidia’s shares surged over 60% since April lows, representing a lucrative selling window for insiders. This trend is not unique to Nvidia; it is a common practice among executives in high-growth companies to lock in profits during periods of heightened market enthusiasm.

Wealth Diversification and Personal Financial Planning

Many executives accumulate significant portions of their net worth in company stock through compensation packages. Selling portions enables them to diversify their investments, manage liquidity for personal goals, or fund other ventures, without necessarily signaling loss of faith in the company. For instance, Jensen Huang’s recent sales could be part of a long-term financial strategy to diversify his portfolio, ensuring financial stability beyond his role at Nvidia.

Regulatory and Insider Trading Framework

Insider trades follow strict compliance rules with staggered timing and disclosures. The recent sales by Nvidia insiders are likely pre-planned transactions aligning with regulatory guidance, further indicating calculated financial decisions rather than hasty moves driven by negative outlooks. The Securities and Exchange Commission (SEC) requires insiders to file Form 4 within two business days of any transaction, ensuring transparency and accountability.

Market Sentiment and Managing Expectations

Executives sometimes sell during market excitement spikes to balance public perception and avoid accusations of over-optimism or withholding gains. It can also be a subtle message to investors to exercise some caution amid hypervaluation. By selling at peak valuations, insiders can send a signal to the market that while they believe in the company’s long-term prospects, they are also practicing prudent financial management.

What Does Insider Selling Reveal About Nvidia’s Future?

Though more than $1 billion in insider stock sales may raise eyebrows, it does not inherently signal trouble or diminished confidence. Several factors argue for a nuanced interpretation:

Underlying Business Strength

Nvidia remains crucial in powering AI development and data center infrastructure, sectors projected for robust growth. The company’s fundamentals and strategic positioning remain solid. Nvidia’s dominance in the GPU market, coupled with its investments in AI research and development, positions it as a leader in the technology sector.

Buyback as a Confidence Signal

The board’s approval of a $50 billion stock repurchase plan demonstrates strong belief in the stock’s medium- to long-term value, aiming to support share prices and enhance shareholder returns. Buybacks can be a powerful tool for returning value to shareholders, especially when the company believes its stock is undervalued or when it aims to offset the effects of insider selling.

Market Reaction

Despite these insider sales, Nvidia’s shares have largely held their gains or continued rebounding. The market recognizes that strategic executive selling is part of normal financial management rather than an alarm bell. Investors often view insider buying as a more significant indicator of confidence, but selling during peak valuations is a common practice and does not necessarily indicate a lack of belief in the company’s future.

On the flip side, insider selling highlights the importance of vigilance. Investors should monitor whether selling trends accelerate, whether insider confidence wanes, or if operational challenges emerge. Keeping an eye on quarterly earnings reports, product launches, and competitive dynamics can provide a more comprehensive picture of the company’s health.

Broader Market and Industry Implications

Nvidia’s insider stock sales are emblematic of a broader trend in AI-driven high-growth stocks that have soared dramatically amid global digital transformation. The stakes are high: valuations can become stretched, and price volatility increases.

For other chipmakers and AI-focused firms, the Nvidia phenomenon serves as a reminder that corporate insiders and institutional investors often recalibrate their exposure as markets evolve rapidly. It underscores the significance of disciplined investment strategies that consider not just growth prospects but also insiders’ moves and company-specific risk factors.

Strategic Takeaways for Investors and Observers

Insider Sales Should Be Contextualized, Not Feared

Executives selling stock during peaks is routine and often part of diversified financial planning rather than a warning sign. It is essential to consider the broader context, including the company’s financial health, market position, and long-term growth prospects.

Track Company Fundamentals Along with Insider Behavior

Focus on Nvidia’s revenue growth, product innovations, AI pipeline, and competitive landscape in conjunction with insider trading trends. A holistic approach to investment analysis can provide a more accurate assessment of the company’s potential.

Consider the Impact of Buybacks

Nvidia’s large-scale repurchase program may buoy share prices, offering a cushion amid market fluctuations linked to insider sales. Buybacks can be a positive signal, indicating that the company believes its stock is undervalued and that it has sufficient cash flow to support such initiatives.

Stay Alert for Shifts in Insider Trading Patterns

Sudden, uncharacteristic increases in insider selling or negative earnings surprises could be red flags warranting a reassessment. Monitoring insider trading patterns over time can provide valuable insights into the confidence levels of those closest to the company’s operations.

Conclusion: Insider Sales Reflect Strategic Moves Amid Record-Breaking AI Surge

The $1 billion-plus stock sales by Nvidia insiders unfold against a backdrop of historic stock price gains propelled by Nvidia’s central role in the artificial intelligence revolution. These sales represent a blend of savvy financial moves, compliance with regulatory frameworks, and personal wealth management rather than a loss of faith in the company’s future.

Investors should interpret this development with a balanced perspective—recognizing the healthy normality of insider sales during peaks while keeping a close eye on Nvidia’s operational performance and market conditions. Nvidia’s stock buyback program, continued technological leadership, and the unstoppable momentum behind AI innovation together drive a cautious but optimistic outlook.

Ultimately, Nvidia insiders cashing out at this stage may be signaling that the company has entered a mature phase of market capitalization where strategic capital redeployment enhances both personal financial security and shareholder value. This episode highlights the dynamic interplay between corporate insiders and market forces in one of the most exciting sectors of modern technology.