Introduction

In the ever-evolving landscape of financial services, JPMorgan Chase is making a bold stride into the retail investment arena. By integrating advanced bond trading tools into its mobile application, the bank aims to attract a broader investor base, leveraging its substantial assets and existing infrastructure. This strategic move is not just about expanding services; it’s about redefining how individual investors engage with financial markets. Let’s delve into the implications, features, and underlying motivations driving this development.

The Landscape of JPMorgan Chase’s Investment Services

JPMorgan Chase & Co. stands as a titan in the global financial arena, managing approximately $4.4 trillion in assets. Its wealth management division, J.P. Morgan Wealth Management, oversees $1 trillion of assets with a network of around 5,800 advisors. Despite its formidable presence across various financial sectors, the bank’s online brokerage arm has been relatively smaller. This new venture into bond trading for retail investors signifies a deliberate effort to capitalize on its existing strengths and broaden its reach in the competitive investment market.

JPMorgan Chase emphasizes client choice, allowing investors to select their preferred investment methods and platforms. This flexibility is a cornerstone of its strategy, aiming to cater to a diverse range of investor needs and preferences. By doing so, the bank positions itself as a versatile and inclusive financial services provider.

The Mobile-First Approach to Bond Trading

The cornerstone of this expansion is the enhancement of the Chase Mobile® app to include bond trading functionality. This initiative aligns with the broader trend of mobile-first investing, catering to the growing number of investors who prefer managing their portfolios on smartphones and tablets. The development team prioritized a seamless user experience, utilizing familiar components from the existing Chase Mobile app to ensure ease of use for current users.

The design philosophy centers on simplicity, cleanliness, and user-friendliness. The mobile architecture is designed to be modular, allowing for the future integration of additional features such as mutual funds, dollar-based trading, and options trading. This forward-looking approach suggests a commitment to continuous improvement and expansion of the platform’s capabilities. The transition from a hybrid mobile app to a native app, specifically developed for iOS and Android, underscores this commitment to performance and user experience.

Accessibility and Investment Minimums

One of the most compelling aspects of JPMorgan’s new offering is the lowered barrier to entry for bond investing. Users can begin trading with as little as $1, making fixed income investments accessible to a broader audience. This strategy is designed to democratize access to bonds, traditionally considered the domain of wealthier investors.

However, it’s crucial to acknowledge the inherent risks associated with bond trading, including the potential loss of principal. JPMorgan Chase explicitly states this risk in its disclosures, emphasizing the importance of informed investment decisions. This transparency is essential in building trust with new investors and ensuring they are well-informed about the risks and rewards of bond trading.

Market Context and Competitive Positioning

The timing of this expansion is strategic. The bond market is projected to reach $1 trillion by 2025, despite prevailing political and economic headwinds. This growth potential provides a compelling rationale for JPMorgan’s investment in this area. While JPMorgan Chase is the largest U.S. bank by assets, it holds a relatively small share of the online brokerage market. This move is a direct attempt to gain market share and compete more effectively with established online brokers.

The addition of bond trading is intended to make JPMorgan Chase a more comprehensive investment platform, capable of meeting a wider range of investor needs. Furthermore, the broader financial landscape is witnessing significant activity, with mergers and acquisitions reshaping the industry. JPMorgan’s strategic moves must be viewed within this context of evolving market dynamics.

Broader Economic and Investment Trends

Several broader economic trends are influencing JPMorgan’s strategy. The increasing focus on Environmental, Social, and Governance (ESG) investing is driving demand for sustainable bonds. This trend is evident in recent financing rounds and debt refinancing for renewable energy projects. Additionally, concerns about tariffs and their impact on various sectors are prompting investors to diversify their portfolios. Fixed income investments, such as bonds, are often considered a safe haven during periods of economic uncertainty. JPMorgan’s emphasis on fixed income investments aligns with this trend, offering investors a means to mitigate risk and preserve capital.

Analysts at JPMorgan Chase also predict continued increases in bank lending, despite a weakening market. This prediction underscores the bank’s confidence in its ability to navigate economic challenges and seize opportunities for growth.

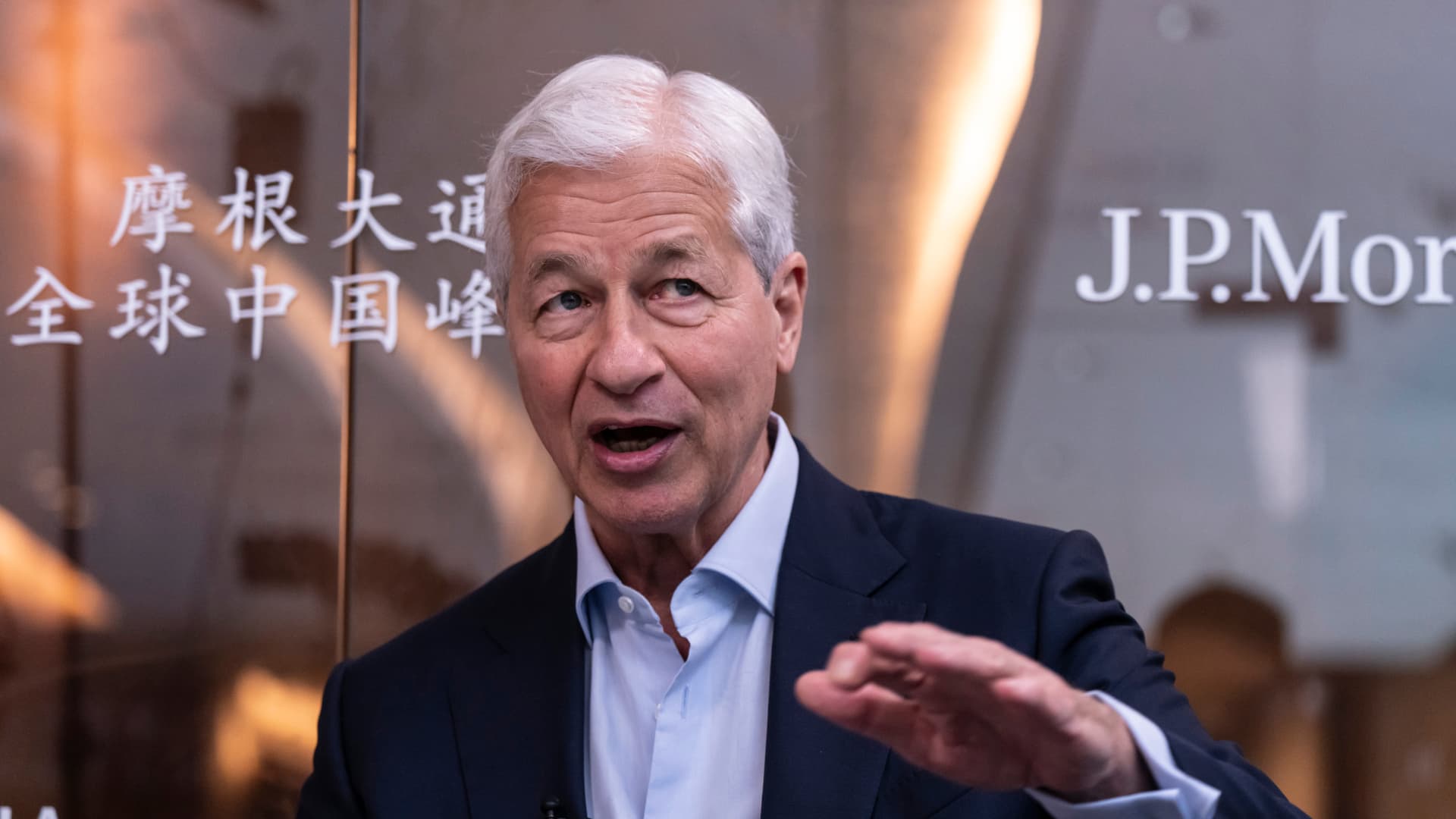

Jamie Dimon’s Vision and Long-Term Strategy

The current initiatives align with the long-term vision articulated by Jamie Dimon, CEO of JPMorgan Chase, in his annual letter to shareholders in 2017. While the letter predates the specific bond trading expansion, it reflects a broader commitment to growth and innovation. Dimon highlighted plans to build up to 400 Chase branches in new markets, demonstrating a proactive approach to expanding the bank’s reach and serving a wider customer base.

The current expansion of mobile trading capabilities represents a continuation of this strategy, leveraging technology to deliver financial services to a broader audience. The company’s substantial asset base provides a solid foundation for these investments, ensuring that JPMorgan Chase can sustain and grow its new offerings.

The Future of J.P. Morgan’s Mobile Investment Platform

The modular architecture of the J.P. Morgan Mobile app suggests a roadmap for future development. The planned integration of mutual funds, dollar-based trading, and options trading will further enhance the platform’s functionality and appeal to a wider range of investors. The app also serves as a central hub for managing accounts, tracking investments, moving money, and accessing thought leadership content. This comprehensive approach positions the J.P. Morgan Mobile app as a powerful tool for both novice and experienced investors. The platform is designed to be accessible 24/7, providing investors with the flexibility to manage their portfolios on their own terms.

Conclusion: A Strategic Bet on the Future of Retail Investing

JPMorgan Chase’s expansion into retail bond trading via its mobile app is a calculated and strategic move. It’s a response to evolving investor preferences, a desire to capture a larger share of the online brokerage market, and a commitment to leveraging technology to deliver innovative financial services. By lowering investment minimums, prioritizing user experience, and building a modular platform for future expansion, JPMorgan is positioning itself as a major player in the increasingly competitive landscape of retail investing.

This initiative isn’t merely about adding a new feature; it’s about redefining JPMorgan Chase’s relationship with the individual investor and solidifying its position as a leader in the future of finance. As the financial landscape continues to evolve, JPMorgan Chase is poised to lead the way, driving innovation and setting new standards for retail investing.